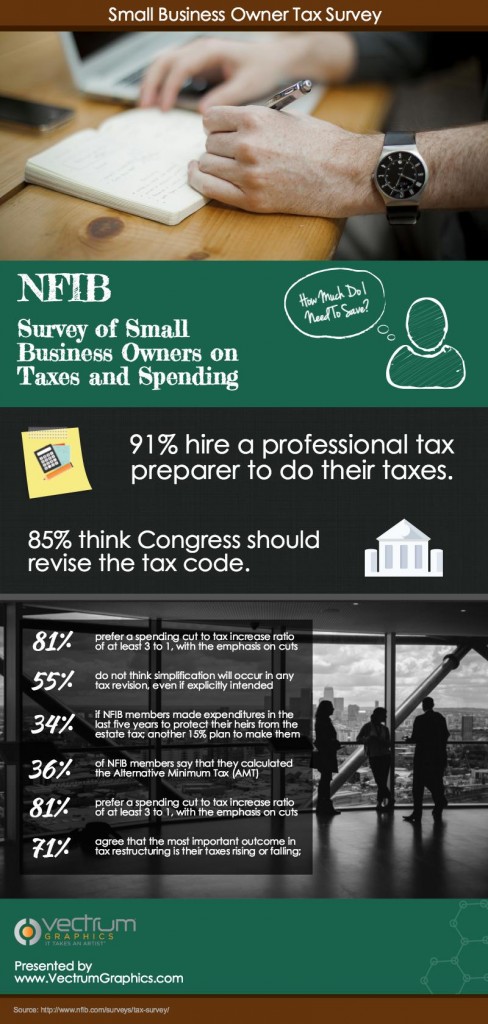

NFIB conducted a survey of small business owners on taxes and spending. Their findings are interesting. See this infographic that we prepared.

- 91% hire a professional tax preparer to do their taxes.

- 85% think Congress should revise the tax code.

- 81% prefer a spending cut to tax increase ratio of at least 3 to 1, with the emphasis on cuts

- 55% do not think simplification will occur in any tax revision, even if explicitly intended

- 34% NFIB members made expenditures in the last five years to protect their heirs from the estate tax; another 15% plan to make them

- 36% of NFIB members say that they calculated the Alternative Minimum Tax (AMT)

- 81% prefer a spending cut to tax increase ratio of at least 3 to 1, with the emphasis on cuts

- 71% agree that the most important outcome in tax restructuring is their taxes rising or falling